By: Matt Garrott

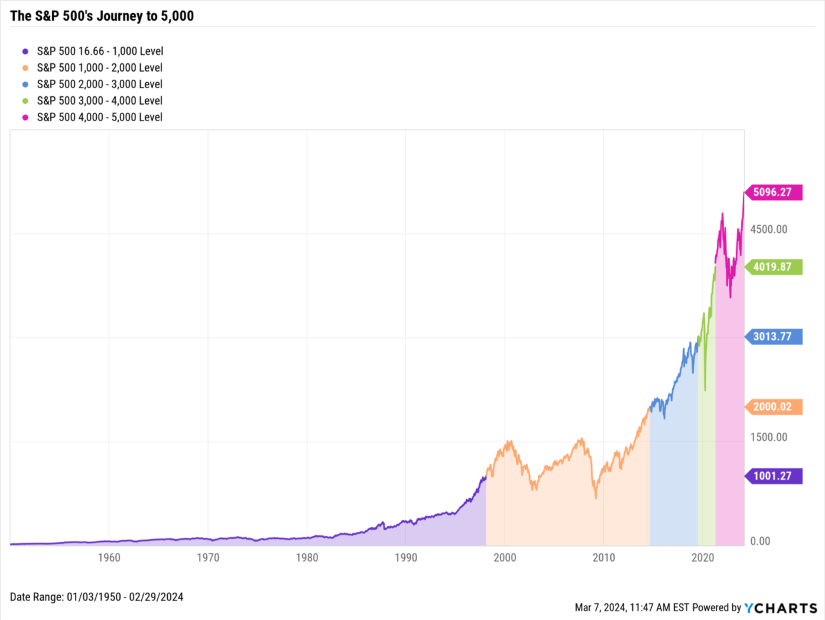

February may be the shortest month of the year, but that doesn’t mean it was boring. The S&P 500 was up 5.3%, breaking through the 5,000 mark and new all-time highs. As you can see below, it took the S&P 500 nearly 50 years to make its first 1,000 points, 65 years to make its first 2,000 points. Yet we’ve now seen the latest 2,000 point move in less than 5 years…despite two bear markets mixed in!

Warren Buffett published his annual letter to Berkshire Hathaway shareholders, the first since his business partner, Charlie Munger, passed away, and it was one of his best in recent years. Here are a couple of passages that resonated with me:

“Though the stock market is massively larger than it was in our early years, today’s active participants are neither more emotionally stable nor better taught than when I was in school. For whatever reasons, markets now exhibit far more casino-like behavior than they did when I was young. The casino now resides in many homes and daily tempts the occupants.”

“One fact of financial life should never be forgotten. Wall Street – to use the term in its figurative sense – would like its customers to make money, but what truly causes its denizens’ juices to flow is feverish activity. At such times, whatever foolishness can be marketed will be vigorously marketed – not by everyone but always by someone.”

Wall Street loves money in motion.