By: Matt Garrott

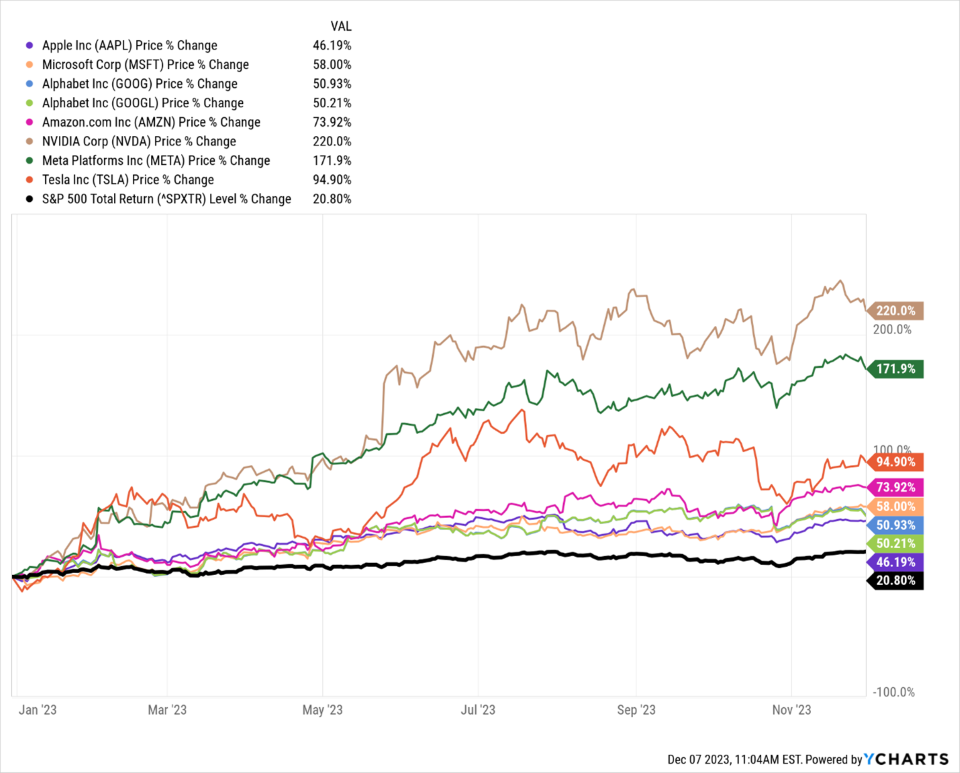

The story of the S&P 500 this year is the Magnificent 7. That is, the seven largest companies in the index by market cap (it’s 8 tickers because Google has two share classes). The S&P is up over 20% year-to-date, mainly because of these giants:

All investment pros had to do to beat the market this year was buy the biggest stocks. For the record, there are 128 stocks besides the Magnificent 7 that have also outperformed the S&P. Anything can happen in December, but taking a peek into large cap manager rankings reveals that the index is ahead of the majority of managers by a pretty big margin.

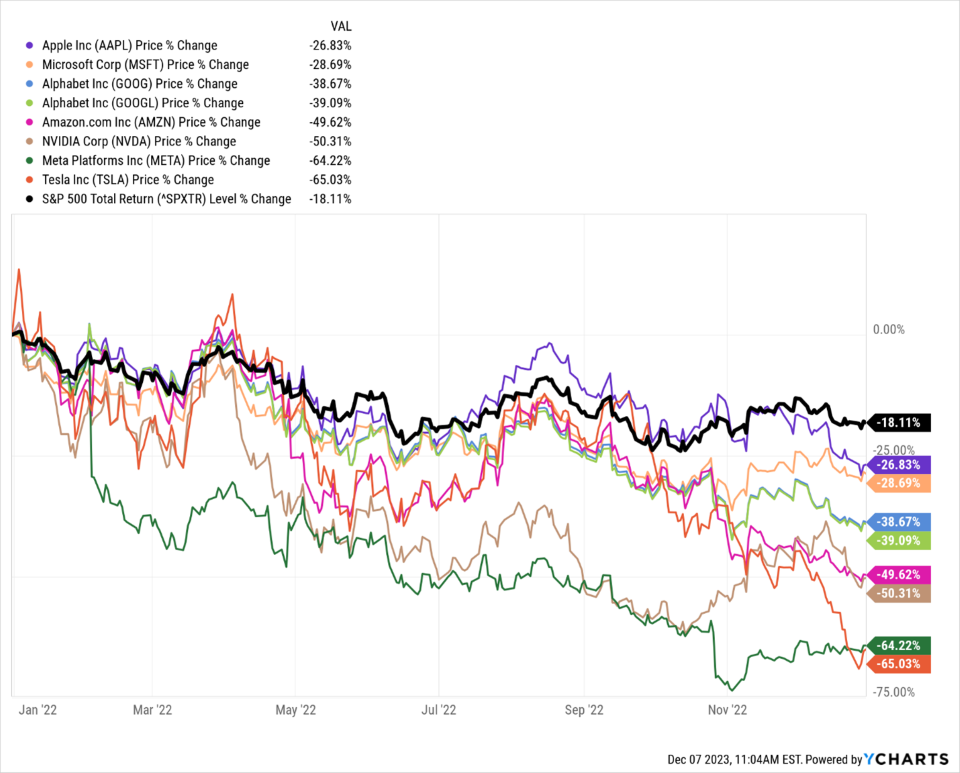

Why didn’t they load up on the mega caps this year? It might have something to do with returns in 2022. Instead of Magnificent, the big stocks were the Stinky 7.

Today’s biggest winners were losers in 2022. Amazon, NVIDIA, Meta, and Tesla were all down by 50% or more. Tesla was the second worst performer in the index in 2022. There were about 300 names that did better than the index overall, but picking a manager that could beat the S&P in 2022 was still a coin flip.

Picking winning stocks is hard, if not impossible. NVIDIA got cut in half in 2022, but is up over 200% in 2023.

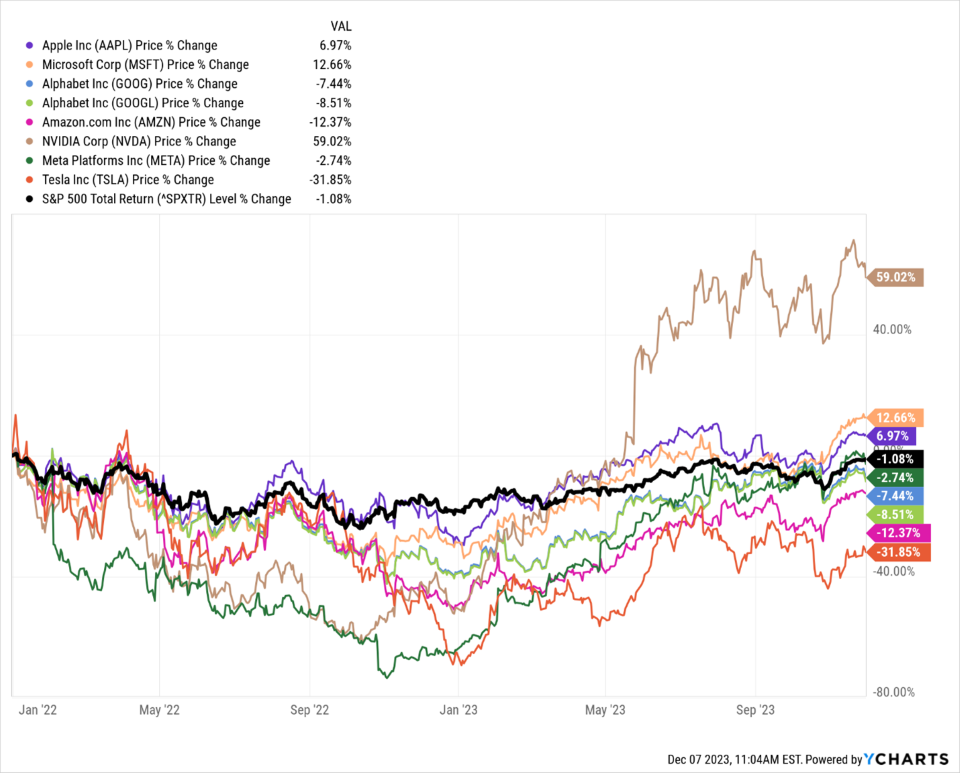

Zooming out across both years, the S&P 500 is back within a whisker of all-time highs.

Apple is up a modest 7%, but that’s over the course of a rollercoaster drop of 27% and rebound of 46%. Meta is up 172% year-to-date, but still hasn’t gotten back to even after almost two years.

Today’s headlines focus on the incredible returns of seven stocks, but zooming out even just one year can make for a change in perspective.