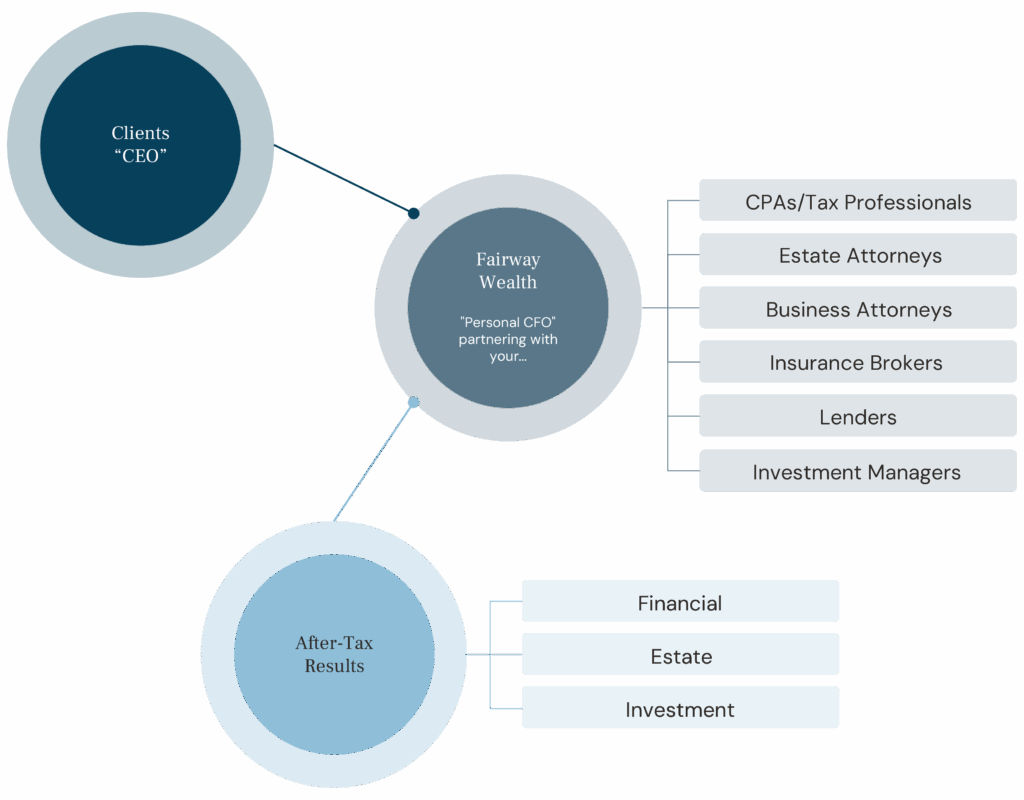

Our client families have created a personal wealth enterprise that requires ongoing management and oversight. While the client generally serves as the CEO of that personal wealth enterprise, Fairway functions as the CFO, providing advice, counsel, and reporting on many things personal-financial. Beyond high-level planning, we are Personal CFOs who manage the underlying architecture that supports long-term outcomes. This includes maintaining an organized financial calendar, tracking filing and renewal requirements, facilitating data flow among accountants, attorneys, insurance providers, and investment managers, and coordinating so that decisions made in one area of your strategy are reflected across all others.