By: Matt Garrott

With a trade war, the Fed’s rate cut, and election season ramping up (none of the challengers will say anything positive about the economy), you may be forgiven for thinking the investing environment is in shambles. However, even after the rough past week, the S&P 500 remains up nearly 15% year-to-date after being up over 20% through July 31. Inflation is low and money is cheap.

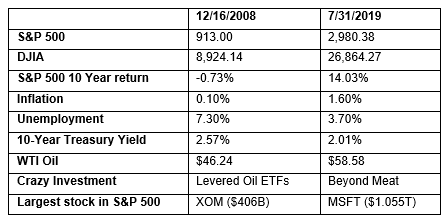

What did things look like in December of 2008, the last time the Federal Reserve cut rates, versus what they look like now?

The last time the Fed cut rates, we were heading into the teeth of the Great Financial Crisis. Unemployment was on its way up to 10%. Concerns over “peak oil” boosted oil prices to almost $150/barrel before crashing into the $30 range.

Today’s economy is robust. The United States is a leading innovator in energy production, biotechnology, and synthetic plant-based non-meat protein substitutes. You’re more likely to find a Soylent Green* dystopia on your neighbor’s grill than in your economy.

*The 1973 sci-fi movie that takes place in the far-future of 2022. A population explosion results in a food shortage. The solution is Soylent, a food made from soy and lentil, but Charlton Heston discovers that not all is as it seems.